Download entire outlook:

Executive Summary

This synoptic mid-year outlook summarizes key insights from recent reports published by leading global financial institutions as of June 2025. This 2025 summary mid-year outlook offers a curated view of market shifts, investment risks, and strategic portfolio ideas. The purpose of this document is to offer our clients a concise and informative overview of dominant themes and strategies across many published mid-year outlooks. It is important to note that this summary does not reflect Tiempo Capital’s market views or investment positions.

Chief Investment Officer

As we reach the midpoint of 2025, investors face a market shaped by persistent volatility and significant economic shifts. Tariff recalibrations continue to influence trade dynamics, introducing uncertainty to global markets. Meanwhile, ongoing fiscal imbalances and diverging central bank policies are reshaping investment landscapes worldwide, prompting many institutions to recommend rethinking traditional investment strategies.

Yet, amidst this complexity, many financial firms point to avenues for growth. While conventional investing playbooks face increasing pressures, institutional outlooks highlight attractive opportunities for selective, well-positioned investors. A commonly cited strategy among these firms is the thoughtfully structured “barbell” approach.

On one side, institutional research emphasizes exposure to high-quality U.S. equities characterized by innovation, resilient earnings, and robust balance sheets—particularly within technology infrastructure, healthcare, and energy modernization sectors. These sectors have demonstrated strength and adaptability even amid uncertainty, according to multiple mid-year analyses.

On the other side, many institutions recommend anchoring portfolios with high-quality fixed-income investments and carefully selected alternative assets. This includes allocating to high-grade bonds, targeted private credit, and inflation-resilient real assets, each designed to help preserve capital, generate stable income, and enhance portfolio stability in volatile conditions.

By curating these industry perspectives, Tiempo Capital aims to equip clients with strategic insights into current institutional thinking. This 2025 summary mid-year outlook is intended to inform, not advise.

II. The Macro Regime: Volatility Is the New Normal

A. Tariff Recalibration and Trade Fragmentation

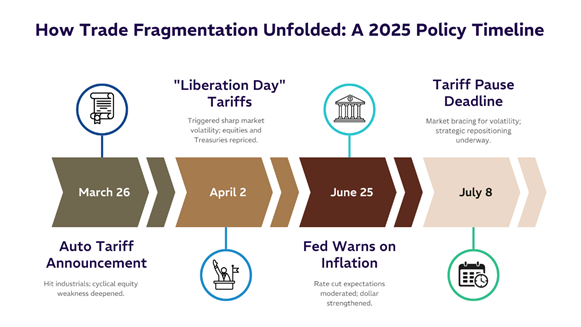

In the first half of 2025, markets have clearly signaled their unease with evolving U.S. trade policy. Recent tariff recalibrations under the renewed Trump administration are reshaping supply chains and injecting uncertainty into global economic growth forecasts. For investors, this means navigating an environment where trade negotiations and tariff rates can trigger sudden market swings, affecting both corporate earnings and consumer demand.

Initially, heightened tariffs created short-term headwinds, dampening consumer confidence and corporate investment plans. Companies responded quickly, recalibrating supply chains to mitigate cost pressures and secure margins. Yet, despite short-term disruptions, many firms identify opportunities: nimble companies—especially those strategically positioned within resilient sectors such as technology infrastructure, healthcare, and private credit—may thrive, turning volatility into advantage.

B. Fiscal Pressures and Market Sentiment

Looking ahead, fiscal complexity remains a defining theme. Rising budget deficits and stimulus fatigue are becoming prominent, particularly as political debates intensify ahead of upcoming elections. Investors are increasingly scrutinizing how these factors might influence long-term interest rates and the strength of the U.S. dollar.

In particular, persistent budget deficits pose significant questions for Treasury bonds and fixed-income markets. These fiscal dynamics, coupled with political uncertainty, may place additional pressure on longer-term bonds. For portfolios, understanding these implications is crucial. Institutional recommendations generally favor a cautiously selective stance in fixed-income holdings, emphasizing quality issuers and shorter-duration assets.

In currency markets, the outlooks anticipate continued softness in the U.S. dollar, reflecting growing fiscal vulnerabilities and narrowing rate differentials with other developed economies. Investors seeking stability may find selective non-US assets attractive, particularly those benefiting from a relatively stronger currency and less fiscal ambiguity.

C. Central Banks: Converging Goals, Diverging Paths

Central banks worldwide face common objectives: managing inflation persistence and supporting economic expansion amid ongoing uncertainty. However, their responses continue to diverge significantly.

In the United States, Federal Reserve Chairman Jerome Powell remains focused and highly data-dependent. Current expectations point toward one more interest rate cut later in 2025, contingent on inflation data and labor market dynamics. This cautious stance underscores the Fed’s delicate balancing act between stimulating economic activity and controlling tariff-induced inflation.

Across the Atlantic, both the European Central Bank (ECB) and Bank of England (BoE) have adopted a more proactive stance. Facing demographic pressures, energy insecurity, and growth downgrades, European policymakers appear set to pursue more aggressive easing measures to revitalize economic momentum.

Japan remains an outlier. The Bank of Japan continues its gradual tightening path as inflation expectations normalize. Most outlooks recommend closely monitoring as they create nuanced opportunities across global markets.

III. Equities: U.S. Leadership Through Innovation and Earnings

A. Earnings Resilience Amid Disruption

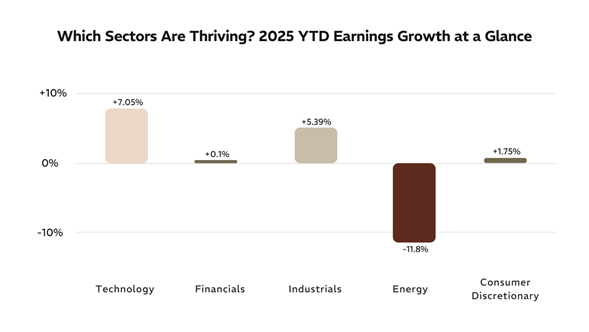

According to the reviewed outlooks, the U.S. equity market continues to showcase resilience, reflecting the strength and adaptability of American businesses. As of mid-year 2025, the S&P 500 has delivered earnings growth between 7% and 9%.

However, performance hasn’t been uniform across sectors. Technology, healthcare, and infrastructure have notably stood out. The technology sector remains robust, buoyed by persistent investments in innovation and digital transformation. Healthcare has benefited from demographic tailwinds and sustained demand, showing defensive resilience even in volatile conditions. Infrastructure has emerged as a crucial area of growth, driven by public and private investments focused on modernization, energy efficiency, and strategic initiatives.

According to institutional research, this underscores a key insight: even amid uncertainty, certain sectors and companies can continue to thrive. Most outlooks suggest that investors benefit from deliberate exposure to resilient, growth-oriented sectors.

B. Beyond the Megacaps: Where Innovation Thrives

While large-cap tech leaders—often dubbed the “Magnificent Seven”—have garnered significant attention and investment flows, the reports suggest investors are increasingly looking beyond these heavyweights to uncover fresh, compelling opportunities.

One such area is AI infrastructure, particularly in sectors such as semiconductors, cloud computing, and industrial technology. Companies enabling advancements in artificial intelligence and providing critical infrastructure for digital expansion continue to offer attractive growth prospects.

Similarly, data centers represent another dynamic segment. As the digital economy expands and AI applications proliferate, data storage and management infrastructure have become indispensable. The outlooks suggest companies well-positioned in this sector may benefit from continued robust demand.

Energy modernization is another key theme. Businesses focused on improving energy efficiency, renewable energy adoption, and smart-grid technologies offer promising long-term potential, particularly given evolving regulations and environmental initiatives.

Additionally, the digital health sector remains appealing. Innovations in medical technology, telemedicine, and healthcare IT are revolutionizing patient care and creating significant value for investors.

Some firms note that contrarian investors might find opportunities in regional banks and industrial automation. While regional banks have faced challenges due to interest rate fluctuations and recent policy shifts, selective institutions with sound balance sheets should offer value and attractive dividend yields. Industrial automation companies, meanwhile, continue to thrive as businesses invest in efficiency, productivity, and supply-chain resilience.

C. Risks and Rotations to Watch

Despite the broader optimism, prudent investors must remain mindful of risks and potential sector rotations.

Tariff-sensitive industries could experience sustained headwinds as trade policy uncertainties persist. Sectors with significant global supply-chain exposure, particularly manufacturing and select consumer goods, may face margin pressures. As such, investors should carefully evaluate exposure to these industries, favoring companies with robust pricing power and supply-chain agility.

Another consideration is the ongoing dispersion among large-cap technology stocks. While mega-cap firms have driven substantial returns in recent years, their dominance may be challenged by regulatory scrutiny, valuation concerns, or emerging competitors. Equal-weight strategies, which offer diversified exposure beyond the largest names, could outperform market-cap weighted benchmarks in this evolving environment.

Ultimately, U.S. equities remain an essential component of long-term investment strategies. However, the outlooks emphasize that precision and selectivity are increasingly important rather than broad-market exposure.

IV. Fixed Income: Income Is Back, With Quality in Focus

A. The Yield Curve Tells a Complex Story

Fixed income markets have shifted dramatically in 2025. After years of navigating historically low yields, investors now find themselves with meaningful income opportunities, particularly at the short end of the yield curve. Higher short-term interest rates, driven by the Federal Reserve’s cautious yet data-dependent stance, offer attractive entry points for income-focused investors.

However, the longer end of the yield curve tells a more complicated tale. Persistent fiscal imbalances and policy uncertainty have introduced volatility into longer-duration bonds. The outlooks acknowledge that many investors remain cautious of holding long-term debt that could be impacted by fiscal pressures or inflation surprises.

In this context, a recurring institutional recommendation is the following: emphasize shorter-duration, high-quality fixed income instruments. This approach captures attractive yields today while mitigating exposure to potential future disruptions.

B. Credit Markets: Selectivity is Non-Negotiable

Credit markets in 2025 present a nuanced investment landscape. While yield opportunities have expanded, the importance of being highly selective cannot be overstated. Given the macroeconomic complexities and continued market volatility, it’s crucial to differentiate between robust companies with strong balance sheets and those more vulnerable to economic stress.

Most outlooks favor investment-grade (IG) credit over high yield (HY). IG issuers typically possess stronger financial profiles, greater pricing power, and more stable margins. These attributes offer resilience, helping investors manage downside risk effectively.

Moreover, structured credit and asset-backed securities (ABS) are gaining investor attention. These instruments offer attractive yields coupled with solid collateral backing. In a year marked by uncertainty, these securities can add a valuable layer of stability and diversification to portfolios.

The consensus advice across research providers is: Prioritize quality and stability in credit exposure. Seek issuers with demonstrated financial strength, dependable cash flows, and the ability to navigate an uncertain economic environment with minimal disruption.

C. Global Bonds and Currency Risk

While the U.S. market offers plenty of opportunities, several firms highlight compelling reasons to look internationally within fixed income portfolios.

European sovereign bonds, in particular, deserve attention. Policymakers in Europe are actively supporting economic growth through accommodative monetary policies. This environment provides a favorable backdrop for European bonds, offering both portfolio diversification and attractive risk-adjusted returns.

In emerging markets (EM), local-currency bonds provide intriguing opportunities. While these bonds carry higher risk due to local market conditions, the yields offered often compensate adequately. Currency appreciation potential in certain EM regions further enhances their appeal. As always, the key here is selectivity: investors must carefully assess each market’s economic fundamentals and political stability before committing capital.

Key Insight

According to the institutional outlooks, those adopting the barbell framework, of short-duration, high-quality U.S. fixed income assets with strategic global positions and selective credit exposure, may be best positioned to navigate market uncertainties while securing attractive returns.

V. Alternatives: Building Inflation Armor and Structural Exposure

A. Private Credit: Expanding Market, Compelling Risk-Reward

Private credit markets have evolved dramatically over recent years, emerging as a critical tool for investors seeking steady yields and reliable returns. In 2025, this asset class continues its growth trajectory, driven largely by banks’ ongoing retreat from traditional lending roles. Institutional research highlights compelling opportunities in direct lending, secondary markets, and specialized debt structures.

Direct lending, in particular, offers attractive yields combined with robust collateral and covenant protections. Sponsor-backed middle-market companies, typically underserved by traditional banks, represent especially promising investments. May reports agree that these businesses often exhibit stable cash flows and strong fundamentals, providing investors a favorable risk-reward profile.

Energy, healthcare, and infrastructure sectors have also emerged as strongholds within private credit. These sectors benefit from persistent demand, supportive regulatory frameworks, and ongoing structural investment trends. Outlooks suggest that investors seeking to manage portfolio volatility, while maintaining attractive returns, would do well to consider these carefully selected private credit opportunities.

B. Infrastructure & Real Assets: The New Income and Growth Play

Infrastructure and real asset investments have become increasingly valuable in today’s economic landscape. Amid inflation persistence and continued market volatility, tangible assets that offer stable income streams and potential capital appreciation deserve heightened investor attention.

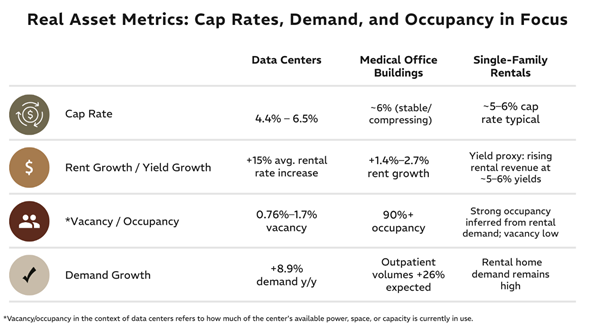

Some authors agree that in real estate, specialized sectors such as data centers, single-family rentals, and medical office buildings remain notably attractive. Data centers continue benefiting from surging demand linked to artificial intelligence and expanding digital infrastructures. Single-family rentals and medical offices similarly offer stability through consistent, recession-resistant demand and demographic tailwinds.

Broader infrastructure assets have also gained prominence. Investments driven by AI expansion, green energy transitions, and reshoring of supply chains are particularly compelling. Governments and corporations alike are increasing their spending in these areas, creating strong structural tailwinds for infrastructure investors. This combination is widely cited as making infrastructure a valuable addition to portfolios.

C. Gold and Commodities: Repricing Geopolitical Risk

In the current macroeconomic environment, gold retains its relevance as an effective portfolio hedge. Geopolitical uncertainties, tariff disruptions, and fiscal complexities make gold appealing as a reliable store of value. Several institutions continue to recommend gold as a hedge for high-net-worth investors.

Conversely, caution is warranted in certain commodities like oil. While the oil market has experienced recent volatility and supply fluctuations, long-term demand uncertainties and geopolitical tensions suggest that investors should tread carefully. Industrial metals, however, offer tactical opportunities, particularly for those monitoring the global economic recovery and evolving infrastructure needs closely.

VI. Strategic Positioning: The Barbell Framework

A. The Barbell Defined

In an environment shaped by persistent volatility, shifting economic forecasts, and changing policy dynamics, a well-structured investment strategy becomes essential. Many institutional outlooks advocate for a clearly defined barbell framework that balances growth potential with defensive stability.

On one side of this barbell, the consensus among firms highlights a focus on resilient, innovation-driven U.S. equities. According to many outlooks, these equities consistently demonstrate earnings strength, backed by robust fundamentals and ongoing innovation. Specifically, sectors such as technology infrastructure, healthcare, energy modernization, and data centers may offer compelling opportunities for investing. By strategically positioning in these areas, investors can benefit from long-term growth and capital appreciation even amid challenging market conditions.

On the opposite side, many outlooks recommend high-quality fixed income and alternative assets that provide reliable income streams and protection against inflation. High-grade bonds, selectively chosen private credit, infrastructure investments, and inflation-resilient real assets like gold help preserve capital, deliver steady returns, and mitigate portfolio volatility. This combination, as cited by many outlooks, aims to ensure that even in uncertain times, portfolios remain balanced and protected.

Connecting these two sides is the bar—comprising tactical liquidity and strategic flexibility. Outlooks often emphasize the importance of liquidity flexibility. It allows portfolios to remain agile, enabling investors to seize emerging opportunities or quickly rebalance in response to market shifts without sacrificing long-term strategic allocations.

B. Portfolio Design Principles

Building an effective portfolio requires adhering to clear, strategic principles. First, selectivity is paramount. Not every investment opportunity is created equal, and the current market environment calls for careful differentiation between assets. Institutional frameworks often emphasize prioritizing quality, stability, and sustainable growth potential.

Second, tax-awareness is increasingly crucial. Adopting a tax-smart investing approach ensures that returns are optimized after taxes—especially valuable for high-net-worth families and entrepreneurs who benefit significantly from strategic tax planning. Aligning investments with tax-efficient structures can markedly enhance long-term wealth accumulation.

Third, active rebalancing is essential to maintaining portfolio alignment. Rather than simply reacting to short-term market noise, investors should proactively assess and recalibrate their positions to reflect their strategic objectives and risk tolerance. Regular, thoughtful adjustments can improve performance and help avoid unwanted risks.

Ultimately, portfolios should be customized according to each investor’s unique financial goals, time horizon, and comfort level with market fluctuations. Institutional guidance supports maintaining long-term alignment rather than short-term reaction, so that investors can confidently navigate evolving market conditions and pursue sustainable growth and wealth preservation.

Closing Thoughts: Thriving Through the Transition

As we move into the latter half of 2025, it’s clear that volatility isn’t just a temporary disruption—it’s part of our new reality. Yet, history teaches us that moments of uncertainty often open doors to significant opportunity.

At Tiempo Capital, our role is to help you confidently navigate this landscape. We bring deep market insights, meticulous risk management, and highly personalized guidance tailored specifically for you. Our commitment is clear: to stand by your side, offering clarity and conviction, helping you capitalize on opportunities that others might overlook.

This transitional period presents an ideal moment to reassess your investment strategy and align your portfolio with your long-term aspirations. As markets evolve, we remain dedicated to your financial well-being, ensuring you’re not just enduring volatility, but thriving through it.

This material is for informational purposes only and does not constitute financial, legal, tax, or investment advice. All opinions, analyses, or strategies discussed are general in nature and may not be appropriate for all individuals or situations. Readers are encouraged to consult their own advisors regarding their specific circumstances. Investments involve risk, including the potential loss of principal, and past performance is not indicative of future results.

Sources

- Amundi Investment Institute. (2025). Mid-Year Investment Outlook 2025: Ride the Policy Noise and Shifts. Amundi Research Center. [Link]

- Apollo Global Management. (2025). 2025 Mid-Year Outlook: Navigating Tariff Shocks and Fiscal Complexity. Apollo Global Management Research. [Link]

- Barclays Research. (2025). Mid-Year Global Investment Outlook 2025. Barclays Investment Research. [Link]

- Charles Schwab & Co., Inc. (2025). 2025 Mid-Year Outlook: U.S. Stocks and Economy. Schwab Market Perspective.

- Encore Capital Management. (2025). Mid-Year Investment Outlook 2025. Encore Investment Insights.

- HarbourVest Partners. (2025). 2025 Midyear Market Outlook: Navigating Private Market Opportunities. HarbourVest Market Insights.

- Hines Global Real Estate. (2025). Mid-Year Outlook 2025: Real Estate Investing in a Shifting Inflation Regime. Hines Research & Strategy.

- HSBC Asset Management. (2025). 2025 Mid-Year Investment Outlook: Managing Through Uncertainty. HSBC Asset Management Perspectives.

- Invesco Ltd. (2025). 2025 Midyear Investment Outlook: Strategic Portfolio Positioning. Invesco Investment Insights.

- J.P. Morgan Asset Management. (2025). Mid-Year Outlook 2025: Global Diversification Amid Uncertainty. J.P. Morgan Guide to the Markets.

- J.P. Morgan Private Bank. (2025). Comfortably Uncomfortable: 2025 Mid-Year Outlook. J.P. Morgan Private Bank Strategy & Insights.

- Morgan Stanley Research. (2025). Global Midyear Investment Outlook 2025: All Eyes on the U.S. Morgan Stanley Global Investment Strategy.

- State Street Global Advisors. (2025). 2025 Midyear Global Market Outlook. State Street Investment Research.

- Wells Fargo Investment Institute. (2025). Midyear Outlook 2025: Opportunities Amid Uneven Terrain. Wells Fargo Investment Insights.