At Tiempo Capital, we are excited to share our latest report, “The Future of Gold: Understanding Gold as a Strategic Asset in Portfolios.” This comprehensive analysis explores gold’s unique role as both a currency and a commodity. It highlights why gold as a strategic asset remains critical for diversified portfolios. With a history of resilience, gold continues to help investors navigate economic uncertainties and protect wealth.

Download the full report on PDF:

CEO

Below you’ll find the entire report, which expounds key findings and trends shaping gold’s future as an investment. Gold’s value as an inflation hedge and its growing importance in central bank reserves make it a compelling addition to any portfolio. These factors further emphasize its relevance as a strategic asset in today’s financial landscape.

We also analyze data showing how gold as a strategic asset mitigates risks, stabilizes returns, and hedges against market volatility. Whether you’re a seasoned investor or exploring gold for the first time, this report provides actionable strategies to align gold with your financial goals.

Read the entire report:

Executive Summary

This report examines gold’s unique role as an asset class, its value dynamics, historical performance, and strategic implications for investors.

Key Highlights:

- Gold’s Dual Role: As both commodity and currency, gold as a strategic asset serves as a stable store of wealth and medium of exchange due to its durability, scarcity, divisibility, and fungibility.

- Value Drivers: Gold prices are influenced by supply inelasticity and demand from jewelry, central banks, investors, and industrial applications.

- Evolving Correlations: Rising central bank demand and geopolitical shifts have reduced gold’s sensitivity to traditional drivers like real bond yields.

- Historical Trends: Gold’s performance reflects global economic and political dynamics, from the Cold War to the Commodity Supercycle and current de-dollarization trends.

- Outlook: Central bank activity and geopolitical fragmentation are expected to sustain gold’s appeal, with potential for a new Currency Supercycle.

Key Risks and Challenges:

- Market Volatility: Gold prices remain sensitive to central bank policies and geopolitical uncertainty.

- Macroeconomic Factors: Changes in real yields or monetary policy could impact gold’s performance.

Recommendations to Use Gold as a Strategic Asset:

- Diversify Portfolios: Allocate 5–15% to gold as a strategic asset for inflation hedging and stability during economic uncertainty.

- Track Central Bank Policies: Monitor reserve activity as a key driver of price movements.

- Leverage Liquidity: Utilize gold’s liquidity for dynamic portfolio adjustments.

Conclusion

Gold’s dual nature as both a commodity and currency positions it as a vital asset in today’s evolving global economy. With central banks driving demand and geopolitical dynamics reshaping financial systems, gold offers unparalleled value for diversification, stability, and long-term growth.

Outlook

The nature of gold as an asset class

Gold, distinct from equities and fixed income, represents a unique asset class. Unlike stocks or bonds, gold’s value is not tied to the performance of a company or government but derives from its dual role as a commodity and a form of currency. This intrinsic and utilitarian value positions gold as an enjoyable good, such as in jewelry or industrial applications, and a durable currency possessing monetary functions.

Gold’s Dual Nature: Currency and Commodity

Gold’s value stems from its physical properties and its role in facilitating financial transactions. It inherently meets the criteria of an effective currency: durability, scarcity, divisibility, and fungibility. These qualities enable gold to function as a reserve of value, a medium of exchange, and a unit of account.

- Durability: Gold resists corrosion and natural deterioration, ensuring its value over time. This longevity underpins its role as a stable store of wealth.

- Scarcity: Limited global reserves make gold a reliable unit of account, as its value remains relatively stable against inflationary pressures.

- Divisibility: Gold can be divided into small, precise amounts without losing its inherent value, making it versatile for transactions of varying sizes.

- Fungibility: Any portion of gold is indistinguishable from another of the same weight and purity, facilitating seamless exchanges.

Value Dynamics: Supply, Demand, and Investment Potential

Gold’s price fluctuations are governed by the law of supply and demand. Unlike businesses, which generate earnings that influence stock values, gold’s intrinsic worth remains unchanged. Its price reflects changes in consumption and production patterns.

Supply: Gold’s production is inelastic; mining is expensive, and reserves are finite, limiting significant supply increases.

Demand: Demand is driven primarily by four factors:

- Jewelry: The largest and most stable source of demand, growing at a steady pace aligned with inflation.

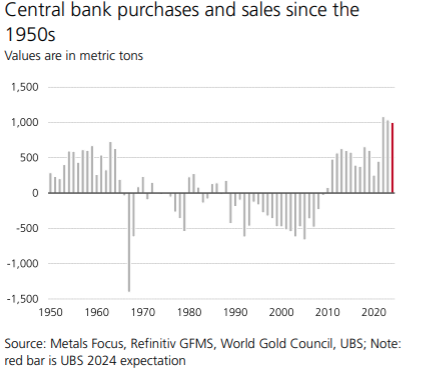

- Central Banks: Their buying or selling activities heavily influence price movements, creating volatility.

- Investors: Individual and institutional acquisitions often mirror market sentiment, amplifying trends.

- Industrial Use: Rising applications in technology contribute to incremental demand growth.

Source: Sprott (2024) An Investor’s Guide to Precious Metals and Critical Minerals.

Gold Prices and Treasury Yields

To better understand the dynamic of gold prices we should mention another important factor that usually affects gold prices: real bond yields. Bond yields are normally inversely related to gold prices for an apparent reason. Real yields are calculated by adjusting nominal interest rates for inflation. They represent the actual return on investments after accounting for the erosion of purchasing power due to inflation. When real yields are high, fixed-income investments like bonds offer attractive returns, making gold less appealing since it does not generate income. When bond yields are low the opposite dynamic takes place.

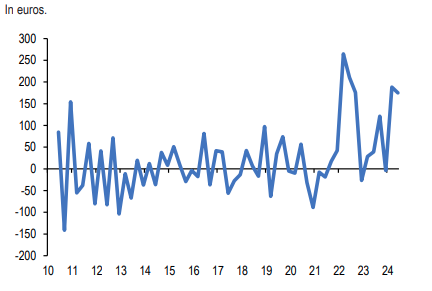

Gold prices have shown decreased sensitivity to real bond yields in recent years. Notably, gold prices have remained elevated relative to 10-year Treasury yields, signaling a structural shift that deviates from the typical relationship between the two assets. This suggests that gold is no longer responding as strongly to changes in bond yields. We attribute this divergence to an unprecedented surge in gold demand from central banks, which has emerged as a significant factor influencing gold’s performance.

The following graph shows the relationship seen by regressing the quarterly changes in gold prices to the quarterly changes in the 10y U.S. Treasury yield. The currency used is the Euro, to eliminate the inverse relationship between gold and the U.S. dollar.

Relationship between gold prices and U.S. 10y treasury yield

Source: J.P. Morgan (2024) Flows and Liquidity: The “debasement trade”

Gold’s Role in Portfolios

Because gold supply is not set to change drastically and jewelry and industrial use demand increased very slowly, gold appeals to those anticipating increased demand by central banks. Central bank activity is by far the most significant driver of price change, with shifts in reserve policies dictating bullish or bearish markets.

Other reasons to buy gold are:

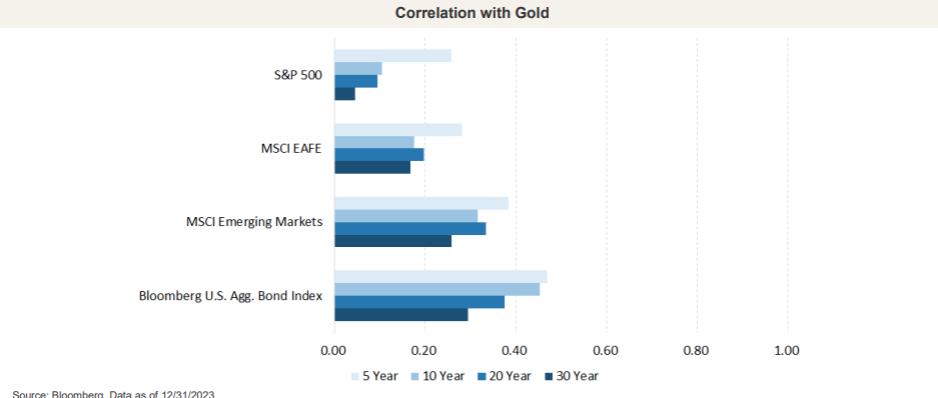

- Gold’s portfolio diversification properties, given its low correlation with other asset classes.

- Its function as an inflation hedge, given gold’s historical property of increasing its price to meet inflation.

- Gold is also considered a safe haven during periods of economic and political turmoil.

- High liquidity: gold is a highly liquid asset that can easily be converted to cash without losing its value.

- Its sense of tangible wealth, which can provide a sense of security for investors.

Source: Sprott (2024) An Investor’s Guide to Precious Metals and Critical Minerals.

The reason to buy gold will thus also be determined by all the previous five factors, among which diversification and inflation hedging are the most prominent. These factors coalesce with how we believe gold prices will vary due to central bank behavior in the ensuing years.

The Variation of Gold Prices in Recent History and the Near Future

Historical Gold Performance in the XXth Century

Gold has experienced significant price variability in the last century. After maintaining stability during the 1920s, gold prices surged during the Great Depression. The abandonment of the gold standard in 1933 initiated a secular bearish market for gold that lasted until the late 1960s. The 1970s saw a period of global turmoil, marked by Cold War tensions and escalating conflicts worldwide. Geopolitical uncertainty and a focus on accumulating power among the world’s leading nations created strong buying pressure for gold by central banks. Other factors driving gold demand included the economic crisis of the 1970s, which led to a loss of faith in markets, the European debt crisis, and the oil crisis.

The 1980s witnessed a loosening of geopolitical tensions as global elites shifted focus to the financial aspects of international relationships. Neoliberal policies gained traction during the 1980s and 1990s, shifting power away from nation-states and toward financial markets and the global financial elite. Global markets experienced sustained growth, as did many economies, particularly China’s, following the market-oriented reforms initiated by Deng Xiaoping in 1978.

The shift in influence—from political power, primarily concentrated in the United States and the Soviet Union and mediated through institutions like the United Nations, to financial and economic power centered on Wall Street, international banks, and the IMF—accelerated after the fall of the Berlin Wall in 1989 and the Soviet Union in 1991.

At the time, many believed the new paradigm of economic liberalism and democracy would lead to global stability—a notion encapsulated by political philosopher Francis Fukuyama’s concept of the “End of History.” Optimism in market efficiency and neoliberal policies, coupled with the popularization of the internet, propelled markets to record highs by 1999.

During this period, major powers like Russia and China liquidated gold reserves, adopting a strategy aligned with strong market dynamics. Surging demand for dollars, alongside a significant increase in gold supply, drove prices to all-time lows. Another factor influencing low gold prices throughout the 90’s was the low debt-to-GDP ratio in the United States, ranging from 52% to 54%. This also propelled the demand for the U.S dollar, furthering weakening gold demand.

Source: UBS (2024) Gold: Shining bright for central banks

Gold Performance in the 2000s: New Power Paradigm

This trend persisted until the early 2000s. The dot-com bubble and the shift in power from the financial sector to political elites marked the end of financial dominance. The 2000s witnessed the judiciary’s growing influence across many nations, with political power recentering on nation-states and coalitions. Countries focused heavily on sovereignty—particularly food, energy, and other critical commodities. China engaged in aggressive commodity buying and supply chain consolidation, particularly in Latin America and Africa. Consequently, the 2000s and early 2010s became the era of the Commodity Supercycle, during which gold experienced a sharp rise. Further strengthening of gold demand was influenced by a secular U.S. dollar market, caused mainly from the United States’ debt-to-GDP ratio increasing steeply from 54% to 96%.

The Temporary Stalling of the Gold Price Surge

By 2013, global power began shifting to legislative elites, reducing the emphasis on sovereignty in favor of political stabilization. Central banks’ moderation strategies and legislative reforms curbed the commodity boom and started a different type of state-centered power. Governments in developed nations prioritized limited strategic cooperation, and deglobalization temporarily stalled. Gold demand from central banks declined, and prices fell accordingly. However, the political elites’ influence remained steady, preventing gold prices from returning to 1980-2000 levels. Even though the debt-to-GDP ratio in the U.S. continued increasing from 96% to 119%, quantitative easing (QE), zero-interest-rate policy (ZIRP), and other stimulative fiscal policies in the U.S. helped to establish a secular dollar bull market that further weakened gold prices.

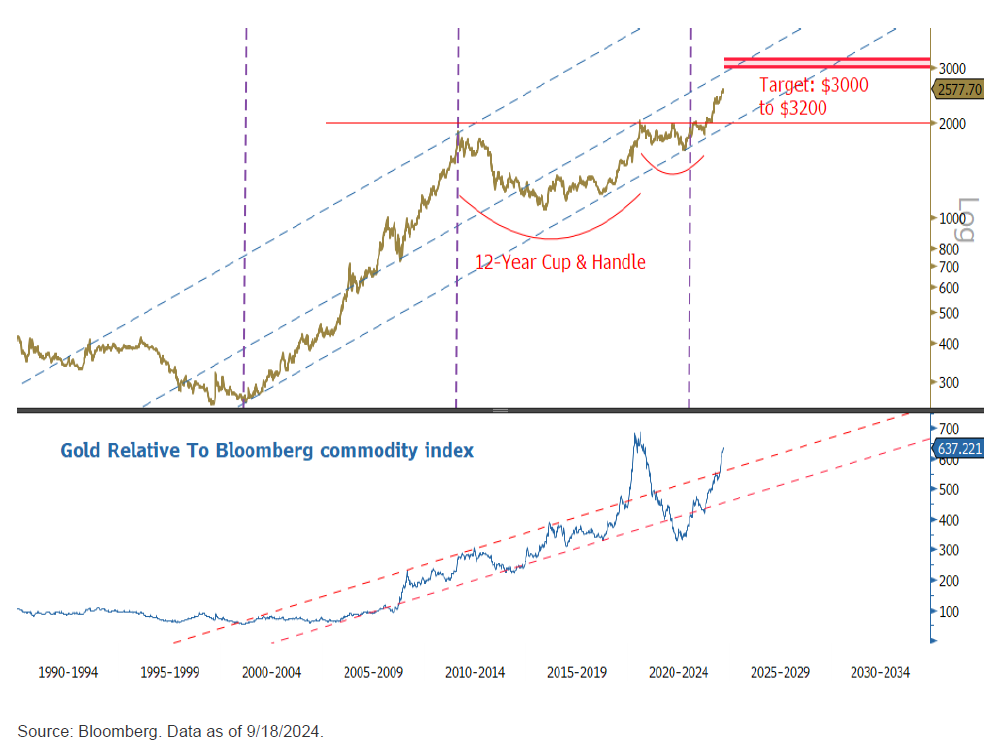

We present below a graph created by Sprott presenting both gold prices in the last 3 decades, and its value relative to the Bloomberg Commodity Index, the latter of which we comment on further below.

Gold price in the previous three decades and gold price relative to Bloomberg Commodity Index

*Source: Sprott (2024) An Investor’s Guide to Precious Metals and Critical Minerals.

The 2020’s: Stronger Central Banks Buying Pressure

The early 2020s ushered in a time of executive power dominance among global elites. Assertive leadership by various heads of state triggered a new wave of conflicts near developed regions (compared to previous conflicts limited to developing countries). Rising tensions among previously cooperative powers and the weaponization of the dollar—particularly against Russia due to the war in Ukraine, and also towards smaller rogue states—spurred de-dollarization among large world powers. Nations pursued financial sovereignty, reducing dependence on the U.S.-controlled financial system. A further increase in debt-to-GDP ratio also weakened the U.S. dollar.

The share of USD in FX reserves as reported by IMF’s COFER data

Source: J.P. Morgan (2024) Flows and Liquidity: The “debasement trade”

This environment led to the greatest surge in gold prices in a century, rising from $1,800 per ounce in December 2022 to approximately $2,800 by October 2024.

The trend toward centralized executive power will likely continue, with further price increases anticipated. Gold prices have currently stabilized because shifts within executive power have temporarily limited its growing influence. However, stronger centralization around presidential authority could emerge before the decade ends, spurring a significant rise in global gold demand. We expect gold prices to rise moderately for the next few years before undergoing a pronounced rise.

Currency Supercycle: The Possibility of a New Stable Price Increase

A repeat of the Commodity Supercycle appears unlikely, as power is no longer concentrated in coalitions like BRICS or the European Union. United States-led international alliances are also weakening. Fragmentation and lack of coordination within these associations are expected to persist. As power consolidates in individual states, gold and other commodity-linked currencies will likely define this decade. The graph above on the relationship between commodities and gold supports this thesis as it shows that gold-to-commodity-price has steadily increased, with a sharp increase since 2019, curbed only by the pandemic.

We anticipate the 2020s will witness a Currency Supercycle, where commodity-backed currencies—unlinked to specific nations—experience substantial gains. Other commodity-backed currencies, such as silver, closely tied to gold, or independent currencies like crypto assets are also likely to benefit. Given their geopolitical importance, the only non-currency-like commodities experiencing the most significant price increases will likely include precious and critical metals and nuclear-related materials.

Gold Price Outlooks and Portfolio Allocation

Several institutions have provided an outlook on gold prices for 2025 and beyond and proposed percentages for gold allocation in a portfolio.

Gold Price Predictions

The following are the gold price predictions from different financial institutions by the end of 2025. All prices are per ounce:

| $2,725 | $2,760 | $2,900 | $2,950 | $2,910 | $3,000 |

| Deutsche Bank | ING | Wells Fargo | J.P. Morgan | Goldman Sachs | Bank of America |

Gold Allocation in a Diversified Portfolio

As we mentioned, gold provides portfolio diversification, is a safe haven during times of high political and economic uncertainty, and provides protection against inflation.

A graphical representation on gold’s performance during periods of economic turmoil can be seen below:

*Source: Sprott (2024) An Investor’s Guide to Precious Metals and Critical Minerals.

The following table states the recommended percentage of gold allocation in a portfolio by different institutions:

| 5% | 7% | 10% | <15% |

| UBS | Amundi | Sprott | Morningstar |

Conclusion

Gold remains a unique and indispensable asset class with a distinct role in investment portfolios. Its dual nature as both a commodity and currency, coupled with its ability to hedge against inflation, diversify portfolios, and provide liquidity during times of uncertainty, makes it an attractive choice for investors. The historical and anticipated trends in gold prices, driven by central bank activity, geopolitical dynamics, and shifting global power structures, underscore its enduring significance in the financial landscape.

As we look toward the future, the potential for a Currency Supercycle and the structural factors supporting gold’s appeal suggest continued opportunities for long-term growth. Whether as a safe haven or a strategic portfolio component, gold offers resilience and stability in an ever-changing economic environment.

Position gold as a core element of your strategic portfolio management. Tiempo Capital integrates gold into diversified portfolios for inflation protection, crisis resilience, and long-term growth — explore our Investment Management services to see how this approach can enhance your wealth strategy. Then, schedule a consultation to begin building a refined portfolio.

This material is for informational purposes only and does not constitute financial, legal, tax, or investment advice. All opinions, analyses, or strategies discussed are general in nature and may not be appropriate for all individuals or situations. Readers are encouraged to consult their own advisors regarding their specific circumstances. Investments involve risk, including the potential loss of principal, and past performance is not indicative of future results.